Renters Insurance in and around Ypsilanti

Ypsilanti renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Ypsilanti

- Superior Township

- Ann Arbor

- Canton

- Milan

- Saline

- Van Buren Township

- Belleville

- Dundee

- Detroit

- Tecumseh

- Romulus

- Wayne

- Toledo, OH

- Maumee

- Perrysburg

Calling All Ypsilanti Renters!

There's a lot to think about when it comes to renting a home - outdoor living space, location, number of bedrooms, house or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Ypsilanti renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

There's No Place Like Home

The unexpected happens. Unfortunately, the stuff in your rented apartment, such as a stereo, a bed and a tablet, aren't immune to tornado or smoke damage. Your good neighbor, agent Shirley Redrick, is committed to helping you know your savings options and find the right insurance options to help keep your things protected.

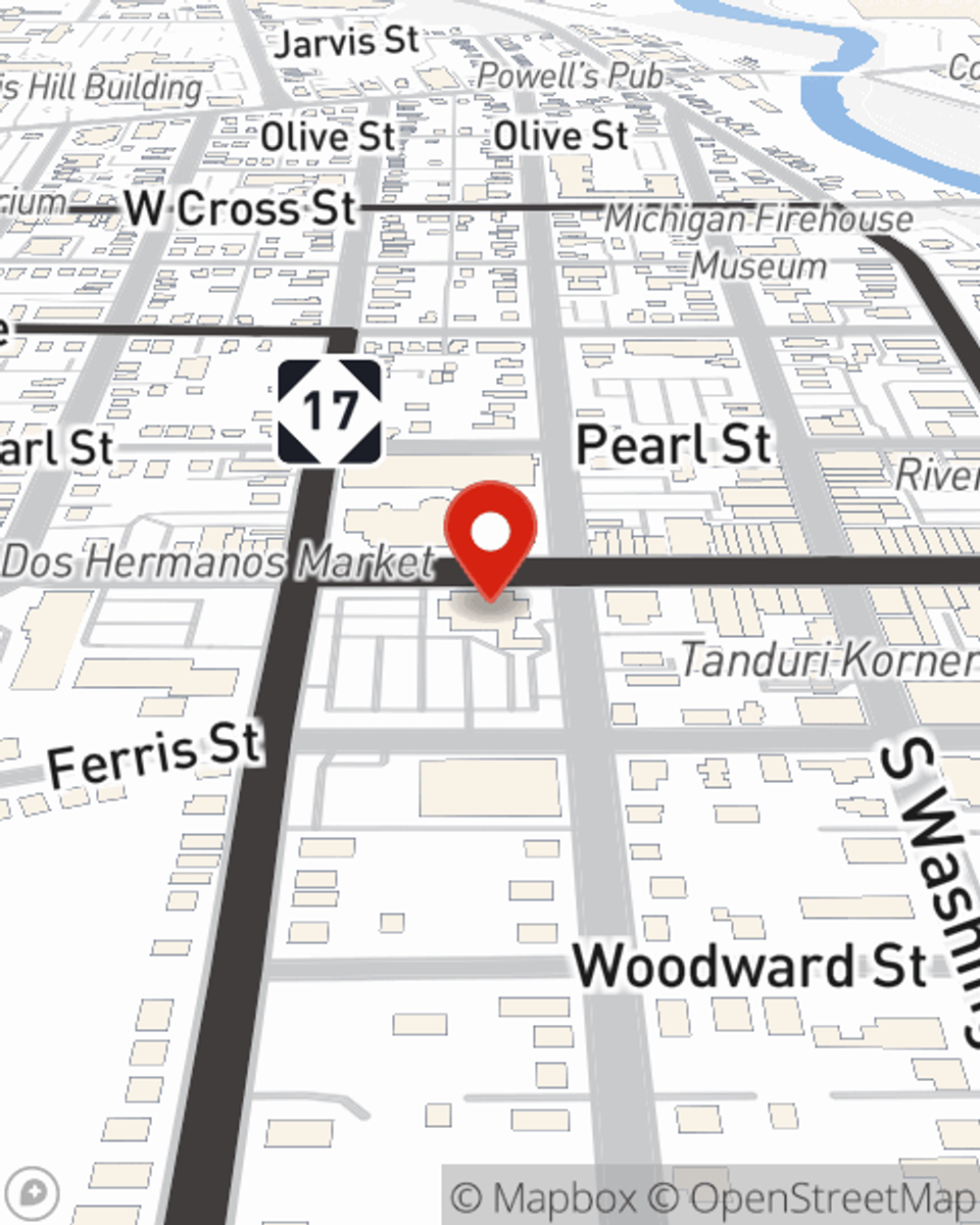

Visit State Farm Agent Shirley Redrick today to discover how the trusted name for renters insurance can protect your possessions here in Ypsilanti, MI.

Have More Questions About Renters Insurance?

Call Shirley at (734) 482-6570 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Shirley Redrick

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.